4 lakh Personal Loan EMI for 14 years

What is the EMI for 4 lakh Personal Loan for 14 years?

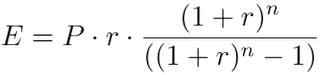

Rs. 4 lakh Personal Loan EMI for 14 years @ rate of interest 9.60% p.a. is Rs. 4,337.21

Check EMI Calculation for 4 lakh Personal Loan for 14 Years or how much EMI you have to pay for 4 lakh Personal Loan amount per month? Check the EMI from HDFC ltd, SBI Bank, ICICI Bank, Kotak, Axis Bank, Bajaj, Bank of Baroda etc.

4 lakh Personal Loan for 14 years, Monthly EMI calculation for popular banks.

| Bank Name | Rate of Interest (p.a.) | Monthly EMI |

|---|---|---|

| Bank of Maharashtra | 9.50% | ₹ 4,313.47 |

| IDFC First Bank | 9.99% | ₹ 4,430.41 |

| HSBC Bank | 10.15% | ₹ 4,468.92 |

| State Bank of India | 10.30% | ₹ 4,505.18 |

| IndusInd Bank | 10.49% | ₹ 4,551.30 |

| Indian Overseas Bank | 10.50% | ₹ 4,553.74 |

| South Indian Bank | 10.50% | ₹ 4,553.74 |

| ICICI Bank | 10.85% | ₹ 4,639.31 |

| HDFC Bank | 10.90% | ₹ 4,651.60 |

| Kotak Mahindra Bank | 10.99% | ₹ 4,673.75 |

| IDBI Bank | 11.00% | ₹ 4,676.22 |

| City Union Bank | 11.00% | ₹ 4,676.22 |

| Karur Vysya Bank | 11.15% | ₹ 4,713.26 |

| Axis Bank | 11.25% | ₹ 4,738.03 |

| Yes Bank | 11.25% | ₹ 4,738.03 |

| Bank of Baroda | 11.40% | ₹ 4,775.30 |

| Federal Bank | 11.49% | ₹ 4,797.73 |

| Central Bank of India | 11.65% | ₹ 4,837.72 |

| Tata Capital | 11.99% | ₹ 4,923.19 |

| Karnataka Bank | 12.00% | ₹ 4,925.72 |

| Punjab National Bank | 12.00% | ₹ 4,925.72 |

| Bank of India | 12.20% | ₹ 4,976.33 |

| IIFL | 12.75% | ₹ 5,116.69 |

| RBL Bank | 18.00% | ₹ 6,535.80 |

| Home Credit | 19.20% | ₹ 6,877.87 |

| Aditya Birla Capital | 19.45% | ₹ 6,949.86 |

See the detailed result for 4 lakh Personal Loan for 14 years @ rate of interest 9.60% p.a.

Loan EMI

₹40,280.00

Total Interest Payable

₹46,67,118.00

Total Payment

(Principal + Interest)

₹96,67,118.00

Personal Loan 2025

- 10 lakh Personal Loan for 4 Years

- 12 lakh Personal Loan for 1 Years

- 15 lakh Personal Loan for 11 Years

- 15 lakh Personal Loan for 15 Years

- 10 lakh Personal Loan for 12 Years

- 9 lakh Personal Loan for 4 Years

- 2 lakh Personal Loan for 8 Years

- 7 lakh Personal Loan for 14 Years

- 2 lakh Personal Loan for 15 Years

- 8 lakh Personal Loan for 2 Years

- 9 lakh Personal Loan for 11 Years

- 8 lakh Personal Loan for 3 Years

- 5 lakh Personal Loan for 3 Years

- 4 lakh Personal Loan for 6 Years

- 5 lakh Personal Loan for 10 Years